The recent heavy rain and subsequent flooding in the United Arab Emirates (UAE) have sparked concerns about their impact on various sectors, including real estate. In Dubai, a city known for its rapid development and thriving property market, the UAE flood has raised questions about property values, investor confidence, and infrastructure flexibility.

Weather’s Wrath: The Impact of the UAE Flood:

- According to the “Washington Post” report, The damage shaped by the recent UAE flood has been extensive, affecting critical infrastructure such as schools and airports. As the flood overwhelmed roads and infrastructure, schools across the federation of seven sheikhdoms were forced to close their doors as a precautionary measure. This disruption not only disrupted educational activities but also posed logistical challenges for families and educators alike.

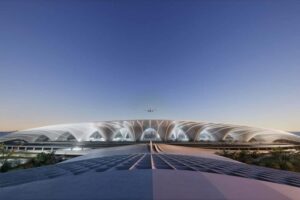

- Similarly, Dubai International Airport, a pivotal hub for international travel, had been affected by the flooding. The flood caused chaos in airport operations, leading to widespread flight cancellations and delays. Passengers faced significant inconvenience as they navigated the chaos caused by the unprecedented weather event, highlighting the weakness of even the most advanced infrastructure in the face of nature’s fury.

- The damage imposed on schools and airports serves as a stark reminder of the importance of strong infrastructure and robust disaster preparedness measures. In the aftermath of the UAE flood, authorities must undertake comprehensive assessments to identify weaknesses and implement mitigation strategies to minimize the impact of future weather-related events.

- Furthermore, the economic effects of the disturbance to critical infrastructure cannot be understated. The closure of schools and disruption of airport operations have ripple effects across various sectors, impacting businesses, tourism, and the overall economy. As the UAE seeks to recover from the aftermath of the flood, concerted efforts are required to mitigate the economic fallout and rebuild stronger, more strong communities.

The Impact of the UAE Flood on Property Values:

One of the immediate concerns following heavy rain and flooding is the potential impact on property values. Properties located in flood-prone areas may experience decreased demand and lower prices as buyers and investors become wary of potential risks. Additionally, damage caused by the UAE flood, such as water infiltration and structural issues, can further reduce property values and discourage potential buyers.

- Investor Confidence:

The real estate market in Dubai thrives on investor confidence, both domestic and international. The recent flooding may have shaken investor confidence, leading to indecision in making new investments or expanding existing portfolios. Uncertainty surrounding the resilience of infrastructure and the effectiveness of flood mitigation measures could contribute to investor caution in the short term.

- Infrastructure Flexibility:

The ability of Dubai’s infrastructure to withstand extreme weather events is under examination following the recent flooding. Questions arise regarding the capability of drainage systems, the resilience of roads and bridges, and the effectiveness of the UAE flood management strategies. Investments in infrastructure upgrades and improvements may be necessary to enhance resilience and restore confidence in Dubai real estate market.

- Insurance Considerations:

Property owners and investors may also review their insurance coverage in light of the recent flooding. Comprehensive insurance policies that cover damage from natural disasters, including floods, become invaluable in such circumstances. Reviewing and updating insurance policies to ensure adequate coverage against potential risks is essential for protecting investments and mitigating financial losses.

- Mitigation Strategies:

To address the challenges posed by the UAE flood, proactive mitigation strategies are crucial. This includes investing in resilient infrastructure, implementing effective flood management measures, and conducting thorough risk assessments for properties located in flood-prone areas. Collaboration between government agencies, developers, and property stakeholders is essential to ensure a coordinated and effective response to future weather events.

- Long-Term Outlook:

While the recent UAE flood may have temporarily impacted the real estate market in Dubai, the city’s resilience and capacity for recovery should not be underestimated. As Dubai continues to invest in sustainable development and infrastructure resilience, the long-term outlook for the real estate market remains positive. By implementing proactive measures and fostering innovation, Dubai can emerge stronger and more resilient in the face of future challenges.

In conclusion, The recent heavy rain and flooding in the UAE have underscored the importance of resilience and preparation in the real estate sector. While the immediate impact on property values and investor confidence may be felt, proactive mitigation strategies and investments in infrastructure can help mitigate risks and ensure long-term sustainability. By addressing the challenges posed by extreme weather events, Dubai can continue to thrive as a global hub for real estate investment and development.