Navigating the Evolving Landscape of Wealth Management in the UAE Market: Insights from the Hubbis UAE Market Independent Wealth Forum 2024

The realm of wealth management in the Middle East, particularly in the United Arab Emirates (UAE), is undergoing a profound transformation. As the region experiences rapid economic growth, political stability, and regulatory reforms, opportunities for wealth creation and management are burgeoning. Against this backdrop, the Hubbis UAE Market Independent Wealth Forum in 2024 was a pivotal platform to explore the industry’s dynamics and chart a course for future success.

The Growth Trajectory of the UAE Wealth Market

The UAE’s wealth market has witnessed exponential growth in recent years, propelled by various factors including economic diversification, infrastructure development, and strategic investments. High Net Worth (HNW) and Ultra High Net Worth (UHNW) individuals are increasingly drawn to the UAE’s vibrant business ecosystem, seeking opportunities for asset preservation, growth, and diversification.

According to recent surveys, an overwhelming majority of respondents anticipate robust growth in the UAE’s Asset Under Management (AUM) segment, with projections exceeding 15% annually until 2030. Statista forecasts the UAE’s wealth management AUM to reach approximately USD 270 billion by 2024, with sustained growth expected in the coming years. This trajectory underscores the immense potential that the UAE wealth market offers for investors, wealth managers, and service providers alike.

Challenges and Opportunities in the Independent Wealth Sector

While the outlook for the UAE market is promising, it is not without its challenges. Independent wealth firms face stiff competition from regional banks, foreign institutions, and each other, necessitating strategic differentiation and value proposition. Moreover, the rapidly evolving regulatory landscape poses compliance and operational challenges for market participants, requiring agility and adaptability.

Despite these challenges, the independent wealth sector in the UAE is ripe with opportunities for growth and innovation. With the right blend of technology adoption, client-centricity, and strategic partnerships, independent firms can carve a niche for themselves in the market and deliver value-added services to their clientele.

The Role of Digital Transformation in Wealth Management

In an increasingly digitized world, the role of technology in wealth management cannot be overstated. Digital tools and solutions have revolutionized the way wealth managers engage with clients, execute trades, and manage portfolios. From Robo-advisors to AI-powered analytics, technology is driving efficiency, transparency, and scalability in wealth management operations.

However, the adoption of digital solutions is not without its challenges. Concerns around data privacy, cybersecurity, and regulatory compliance often act as barriers to technology adoption in wealth management. Nonetheless, forward-thinking firms recognize the transformative potential of digitalization and are investing in robust IT infrastructure and talent to stay ahead of the curve.

Collaboration and Ecosystem Integration

In the competitive landscape of wealth management, collaboration is key to success. Independent wealth firms must forge strategic partnerships with banks, asset managers, regulators, and technology providers to enhance their value proposition and deliver holistic solutions to clients. By leveraging the strengths of each ecosystem player, firms can unlock synergies, expand their service offerings, and enhance client satisfaction.

Regulatory Environment and Investor Confidence

The regulatory environment plays a pivotal role in shaping investor confidence and market integrity. In recent years, the UAE authorities have implemented progressive regulatory reforms aimed at enhancing transparency, investor protection, and market stability. Initiatives such as foreign ownership liberalization, golden visa programs, and tax incentives have bolstered investor confidence and attracted foreign capital to the UAE Market.

Moreover, regulatory sandboxes and innovation hubs have fostered a culture of experimentation and entrepreneurship, enabling fintech startups and wealth management firms to test new products and services in a controlled environment. This regulatory agility bodes well for the long-term growth and sustainability of the UAE market.

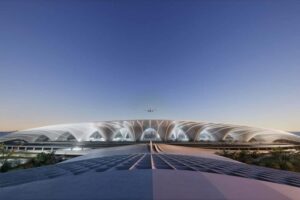

Dubai: A Global Financial Hub

At the heart of the UAE’s wealth ecosystem lies Dubai, a global financial hub renowned for its business-friendly environment, world-class infrastructure, and cosmopolitan culture. Dubai’s strategic location, state-of-the-art infrastructure, and forward-thinking leadership have positioned it as a preferred destination for global investors, entrepreneurs, and high-net-worth individuals (HNWIs).

The Dubai International Financial Centre (DIFC) serves as the epicenter of Dubai’s financial services industry, housing over 2,500 firms including banks, asset managers, and fintech startups. With its robust regulatory framework, tax-efficient regime, and proximity to emerging markets, DIFC offers unparalleled opportunities for wealth management firms to expand their presence in the region and tap into new growth markets.

In addition to its thriving financial ecosystem, Dubai boasts a diverse array of lifestyle amenities, cultural attractions, and leisure activities, making it an attractive destination for affluent individuals and families seeking a high-quality living experience. From luxury shopping malls to gourmet dining establishments, Dubai offers a plethora of leisure options to cater to the discerning tastes of its residents and visitors alike.

The Way Forward: Insights from the Hubbis UAE Market Independent Wealth Forum 2024

As we look towards the future, the Hubbis UAE Market Independent Wealth Forum 2024 provides a unique platform for industry stakeholders to exchange ideas, share best practices, and chart a course for sustainable growth in the UAE wealth market. By fostering collaboration, innovation, and thought leadership, the forum aims to empower wealth managers and service providers to navigate the evolving landscape of wealth management successfully.

Key themes and topics to be explored at the forum include:

1. Digital transformation in wealth management: Harnessing the power of technology to drive operational efficiency, enhance client engagement, and unlock new revenue streams.

2. Regulatory compliance and risk management: Navigating the complex regulatory landscape, addressing compliance challenges, and mitigating operational risks to ensure business continuity and client trust.

3. Client-centricity and value proposition: Understanding the evolving needs and preferences of high-net-worth clients, delivering personalized services, and building long-term relationships based on trust and transparency.

4. Ecosystem integration and collaboration: Forging strategic partnerships with banks, asset managers, and technology providers to deliver holistic solutions and create value for clients.

5. Sustainable investing and impact wealth management: Incorporating environmental, social, and governance (ESG) criteria into investment decision-making, and leveraging impact investing strategies to drive positive social and environmental outcomes.

6. Talent development and leadership: Attracting and retaining top talent, fostering a culture of innovation and excellence, and developing the next generation of wealth management leaders.

In conclusion, the Hubbis UAE Market Independent Wealth Forum 2024 promises to be a thought-provoking and insightful event, bringing together industry leaders, regulators, and thought leaders to discuss the opportunities and challenges facing the UAE market. By harnessing the power of collaboration, innovation, and technology, wealth management firms can unlock new growth opportunities and deliver value-added services to their clients in the dynamic and ever-evolving landscape of the UAE Market.