Due to rising housing demand and prices in the city’s real estate market brought about by population growth, experts say the best places to stay in Dubai have grown more appealing for buy-to-rent investments.

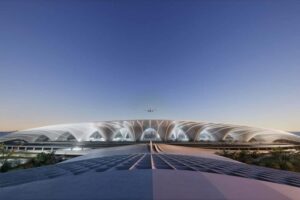

In addition to population growth and significant infrastructure improvements, such as the construction of Al Makoum International Airport, which are driving up rental yields in the best places to stay in Dubai and its districts, Dubai’s real estate market offers chances for investors seeking rental income at various price points.

Landlords are in a good position to profit from Dubai’s housing demand since off-plan community acquisitions offer reduced entry points and the possibility of appreciation following completion.

Before explaining the best places to stay in Dubai, what is “buy-to-rent”?

Buying a property in the best place to stay in Dubai to rent it out to tenants rather than relocate is known as buy-to-rent. The main goal is to gradually increase the property’s rental income so investors can have a steady flow of profits.

This strategy’s purchased properties are not intended for residential use by the buyer; they are solely seen as investment vehicles to generate rental profits.

While receiving monthly or yearly rent from tenants who occupy the property in the best place to stay in Dubai is the primary source of profits, investors may also profit from possible capital gain if the property’s value rises while they are owners.

Landlords in the best places to stay in Dubai are required to record lease agreements with the RERA website, Ejari. Pay housing fees to the Dubai Municipality, which are added to their monthly electricity and water bills and are computed as 5% of the annual rental rates.

Rental increases may be implemented in line with Dubai’s local law No. 43 of 2013 when compared to the average rent in the neighborhood as determined by the RERA increase calculator.

What are the greatest neighborhoods in Dubai for “buy-to-rent” real estate?

Prices are rising everywhere in Dubai; no area is exempt from rising rental costs. According to Jacob Bramley, leasing manager at Better Homes, properties in established central communities like Downtown Dubai, Meydan, Emirates Living, Jumeirah, Dubai Marina, and Palm Jumeirah are typically highly sought after, with tenants willing to invest a top dollar in these communities.

The investor’s top goal is to determine which is the best place to stay in Dubai with a good rental return.

Jumeirah Village Circle (8%), Dubai Sports City (8.4%), and Arjan (8.4%) are a few of the best places to stay in Dubai for residential neighborhoods with strong rental yields. Young people and new expats are drawn to these residential communities, which sustain robust rental demand and good investor profits. Investors may anticipate up to 5% annual rental returns in the major city center locations, such as Downtown Dubai, Business Bay, and Dubai Marina, he added, noting that these neighborhoods continue to be highly preferred by renters desiring to dwell in the center of the city.

Demand for rentals is “growing” in Dubai South.

One of the best places to stay in Dubai communities near Dubai South is seeing a recent increase in popularity and demand for rentals.

For instance, rental demand has increased by 16% in Downtown Jebel Ali year over year, whereas it has increased by 8% in Dubai Investment Park during the same time frame. Given that Dubai South is poised to become the hub of Dubai in the next few years, investors seeking to make long-term investments in the best places to stay in Dubai can anticipate returns of more than 10% in these sectors.

Dubai South and Expo have attracted a lot of attention with the announcement of Al Maktoum International Airport’s expansion.

The long-term goals and room for expansion in Dubai Creek Harbour and the introduction of brand-new villa communities in Dubailand—the area between E311 and E611—also make an impression on us, said Bramley of Betterhomes.

The demand for rentals is rapidly increasing in Dubai’s best places, such as Dubai Science Park, Dubai Studio City, and Mudon.

Dubai Science Park, which has increased by 15% annually. Similarly, he stated that Mudon (11%) and Dubai Studio City (12.4%) are two outlying towns that are seeing a rise in demand.

The demand for rentals in developing areas like JVC, Tilal Al Ghaf, Dubai Hills Estate, and Dubai Creek Harbour is rising, and additional phases and amenities will be added.

What regions ought investors to concentrate on then?

Bramley says it’s critical that investors set their investment goals before he suggests topics for them to concentrate on.

While some prioritize long-term wealth appreciation, others may strive for the maximum return on investment available in the market. To recover their investment, some investors can purchase properties off-plan in the best places to stay in Dubai and sell them soon after.

Current trends show investors are more interested in emerging towns where they see room for long-term capital appreciation and rental price hikes.

Gross yields of 10–20% are typical. In areas like La Rosa in Villanova, off-plan purchases from 2020 turned over a 10% return on investment. Depending on when the owner purchased it, some existing villa communities are seeing even larger returns, according to Bramley.

Which kinds of properties or locations have the highest long-term potential for appreciation?

Villa communities have shown excellent long-term appreciation, but this trend is widespread across the market. Established apartment complexes like Dubai Marina and Downtown have had similar success over the past four years.

Off-plan properties are the best place to stay in Dubai; however, they would be the best investment choice if people considered long-term value potential. We need to look at places that are now in the process of getting “fully developed.”

One location that is expected to gain significant value over the next few years is Dubai South. Purchasing off-plan now will yield the most because off-plan flats are typically offered for less money.

Suburban locations like Dubai South and Tilal Al Ghaf are worth considering as the best places to stay in Dubai for investors looking to make investments that are anticipated to appreciate in the foreseeable future.

These places will provide significant returns over the next few years due to the announcement of the new Al Maktoum airport and a trend of higher demand in suburban areas.

The best places to stay in Dubai are the center locations like Dubai Marina, Downtown Dubai, and DIFC long-term investments. Although the rental returns will be reduced, there will always be a significant demand for the property for rental purposes and future sales. He stated that it’s the same mindset as investors who choose to invest in central London.

What additional aspects should investors take into account besides returns?

Investors had to see different aspects, such as the properties and whether they were in the best places to stay in Dubai, in addition to profits.

The property’s value will probably rise if an investor keeps it for a while before selling it. Additionally, buyers should consider whether the property’s use will alter in the future.

Would they ever reside there, or perhaps a family member? Would they rent it out for a set amount of time? As the city grows into secondary and tertiary communities, ideal locations near the shore are projected to continue doing well, he said, pointing to the strongest rental market performance over the next five to ten years.

Before investing, investors need to think about the community’s amenities. Over the next 10 years, will the neighborhood have enough draw factors—such as top-notch recreational centers—to entice individuals to relocate there and sustain a high demand?

Strong rental market growth over the next 5–10 years is predictable in the best places to stay in Dubai.

While the main city centers will continue to see sustained demand, the expanding population will drive further demand toward the suburbs.

Typically, new residents start by renting in popular and affordable residential areas such as Jumeirah Village Circle (JVC) and gradually move closer to central locations and some of the best places to stay in Dubai, such as Downtown Dubai or Dubai Marina. When renters have been in Dubai for longer and start settling down with a family, they often look to move into villas in suburban areas to get a house with more space and family-friendly environments.

Investors can get the best returns by buying properties in the best places to stay in Dubai that are just starting to gain full recognition. These locations frequently experience significant gains after completion, enabling investors to profit from off-plan acquisitions at reduced costs, the speaker stated.

Regarding any noteworthy price increases or decreases across various areas in Dubai in the recent past, the property market in Dubai has been seeing an upward trend for three years running since the end of the COVID-19 pandemic.

Prices have risen by double-digit percentages in all communities, from popular suburban areas like Arabian Ranches to city centers like Downtown Dubai. He added that the growing population has led to an overall increased demand for more properties in a wider geographical distribution.

Some of the best places to stay in Dubai, like Mira, Town Square, and Mudon, felt remote from the main city center a few years ago. This view has significantly changed in the modern era due to population growth, as suburban areas are now in great demand. Due to present supply constraints, prices across the board have increased in Dubai over the past few years.

Choosing the best places to stay in Dubai, whether for commercial or residential properties, is considered a wise choice due to the high rental demand and potential for high rental yields, the affordable yet high-quality lifestyle, the self-contained area with amenities and retail options, and the strong demand for property sales.

Investors consider their investment goals, such as long-term wealth appreciation or maximum return on investment. Additionally, factors like community amenities, future development plans, and the potential for capital appreciation should be considered when choosing the best places to stay in Dubai for buy-to-rent properties.