Saving money in the bank VS real estate investing: which is better ?

There are two common ways to save money: putting money in a bank account or buying real estate. Both offer advantages and disadvantages, and the choice ultimately comes down to a person’s financial objectives and risk tolerance.

Putting money in a bank account; For many people, opening a bank account is the most popular way to save money. It is a low-risk choice that provides the FDIC guarantee for deposits up to $250,000 in security. Savings accounts, checking accounts, and certificates of deposit (CDs) are just a few of the accounts that banks provide. These accounts often have low interest rates, but a return is always assured.

Liquidity is the main advantage of saving in a bank account. There are no fees associated with the rapid and simple access to funds. This makes it a smart choice for supplemental savings or short-term financial objectives.

The poor rate of return on investment is the drawback of saving in a bank account. Since interest rates are frequently lower than the rate of inflation, money gradually loses value. Additionally, because of the low interest rates, the money is not working hard to increase in value.

Real Estate Investing;

Real estate investing is purchasing and maintaining assets in order to produce income or capital growth. Purchasing rental homes, home renovation projects, and REIT (real estate investment trust) investments are just a few of the many methods to invest in real estate.

The possibility for significant profits is one of the main advantages of real estate investing. Rental properties have the potential to increase in value over time and produce passive income through monthly rent payments. If done properly, flipping houses can also be profitable.

Diversification of an investment portfolio is another benefit of real estate investing. Investments in real estate can act as a hedge against market volatility since real estate values don’t always move in the same direction as the stock market.

But there are risks involved in real estate investing. A property must be purchased with a sizable initial investment, and there are continuous expenses related to keeping the property maintained. Real estate might be challenging to sell fast if necessary because it is a relatively illiquid investment.

Real Estate Investing and banking savings

The potential return on investment is the primary differential between bank savings and real estate investing. Bank deposits are very safe and liquid despite having a poor rate of return on investment. Real estate can yield large returns on investment, but the risk and liquidity are higher.

A wise choice for short-term financial goals or emergency funds is to save in a bank account. The quick and easy access to the funds is provided without any fees. For long-term savings or investment goals, real estate investing, however, might be a better option. A portfolio of investments can be diversified with real estate, which also has the potential to generate sizable gains over time.

Ultimately, a person’s financial objectives and risk tolerance will determine whether they choose to save in a bank account or invest in real estate. Savings with a bank might be the best choice for people who value liquidity over risk. Real estate investing might be a preferable choice for people who are prepared to assume more risk in exchange for the chance of bigger profits.

Regardless of which option is chosen, it’s important to set clear financial goals and understand the full scope of the risk involved. Once these factors have been taken into account, people can make an informed choice that best fits their needs.

Conclusion

Financial planning includes saving money as a crucial component. Both putting money in a bank account and buying real estate are sensible choices, but they each have advantages and disadvantages. Even while saving in a bank account is low risk and very liquid, the return on investment is modest. High profits on investment are possible with real estate, but the risk and liquidity are higher.

The choice between bank savings and real estate investing ultimately comes down to a person’s financial objectives and risk tolerance. Before making a decision, it’s necessary to take everything into account, including the risks, liquidity, and prospective profits.

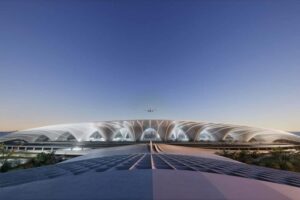

Check out our real estate investing opportunities with easy payment plans and facility on payment methods, including bank transfers, cash, crypto and many more on www.backyard.ae